Introduction to the Russianmarket

Are you searching for new opportunities in the world of investing? The Russianmarket might just be the hidden gem you’ve been seeking. With its vast resources and dynamic economy, this market has piqued the interest of many savvy investors looking to capitalize on quick financial gains. But is it truly a goldmine waiting to be discovered, or does it come with its own set of challenges?

As we delve into the intricacies of investing in the Russianmarket, you’ll uncover valuable insights that can help you navigate this unique landscape effectively. Buckle up as we explore potential rewards and pitfalls that await those daring enough to step into this vibrant marketplace.

Advantages and challenges of investing in the Russianmarket

Investing in the Russianmarket offers unique opportunities for savvy investors. One key advantage is its potential for high returns. The market has seen rapid growth in specific sectors, particularly energy and technology.

Additionally, the Russianmarket often operates independently of Western markets. This can provide diversification benefits to an investment portfolio, allowing investors to hedge against global economic fluctuations.

However, challenges abound as well. Political instability remains a significant concern. Investors must navigate complex regulations that may change unexpectedly.

There’s also volatility inherent in emerging markets like Russia. Sudden shifts can impact stock prices dramatically, requiring quick decision-making from investors.

Access to reliable information can be limited compared to more developed markets. Thorough research and local insights are crucial before diving into investments here.

Understanding the current economic climate in Russianmarket

The current economic climate in the Russianmarket is complex and multifaceted. Numerous factors influence its dynamics, from geopolitical tensions to domestic policies. Recent sanctions have significantly impacted various sectors, creating both hurdles and opportunities.

Despite challenges, certain industries are resilient. The energy sector remains robust due to high global demand for oil and gas. Tech companies are also emerging as innovators amid adversity, focusing on digital solutions tailored for local needs.

Inflation rates fluctuate but remain a point of concern for investors. Currency volatility adds another layer of complexity that requires careful navigation.

Understanding consumer behavior is crucial here as well. Many Russian-market.cc prioritize essential goods over luxury items during uncertain times, shifting market demands accordingly.

Investors must stay informed through reliable news sources and analytics to grasp the evolving landscape adequately. Adapting strategies in real-time can lead to better outcomes amid this fluid environment.

Top industries and companies to consider for investment

When exploring the Russianmarket, several industries stand out for potential investment opportunities. The energy sector is a key player, with companies like Gazprom and Rosneft leading in natural gas and oil production. Their established infrastructure and global demand create attractive prospects.

Technology is another growing field worth considering. Companies such as Yandex are revolutionizing online services in Russia, from search engines to e-commerce platforms. Investing here could yield significant returns as digital transformation continues.

Additionally, consider the consumer goods industry. Major players like Magnit are capitalizing on changing shopping habits and increasing disposable incomes among Russians.

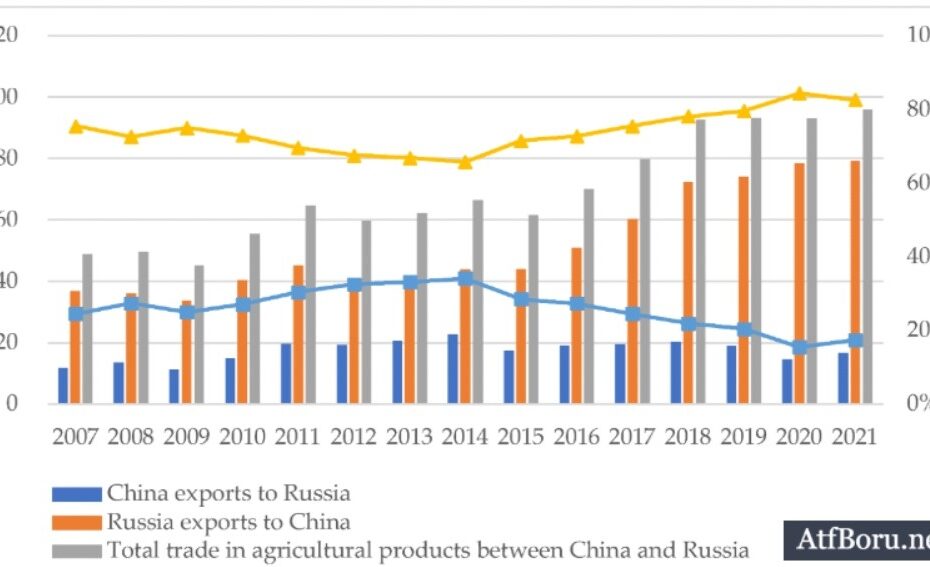

The agricultural sector presents unique opportunities too. Firms involved in agribusiness may benefit from rising food demands both locally and globally as Russia enhances its export capabilities within this space.

Risks and precautions to take when investing in Russianmarket stocks

Investing in the Russianmarket can be enticing, but it comes with notable risks. The political landscape is often volatile. Changes in government policy or sanctions can dramatically affect stock prices.

Economic fluctuations also pose a challenge. Currency instability and inflation rates may impact your returns. Staying informed about these factors is essential.

Another risk involves market transparency. Information on companies might not always be reliable or readily available. Conduct thorough research before making any investment decisions.

Diversification is key to mitigating risks in this environment. Don’t put all your funds into one sector or company; spread them across various industries for better safety.

Consider utilizing local expertise or financial advisors who understand the nuances of the Russianmarket login well. Their insights can help you navigate potential pitfalls effectively while maximizing opportunities for growth.

Tips for success in the Russianmarket

To thrive in the Russianmarket, start by conducting thorough research. Understand market trends and consumer behavior specific to Russian-market.cc.

Networking is essential. Connect with local investors and industry experts who can provide insights you might not find online. Attend events or webinars focused on the Russian economy.

Diversification should be a key strategy in your investment approach. Spread your investments across various sectors to minimize risk.

Stay updated on geopolitical events that may affect the market landscape. Knowing what’s happening politically can help you make informed decisions.

Consider using local brokerage firms for easier navigation through regulations and market nuances.

Maintain a long-term perspective rather than seeking short-term gains alone. Patience often yields better financial outcomes in this complex environment.

Conclusion: Can you make quick financial gains through investing in the Russianmarket?

Investing in the Russianmarket can certainly present opportunities for quick financial gains. However, it’s essential to consider both the potential rewards and inherent risks. The landscape of this market is dynamic, influenced by global economic factors and local policies.

While certain industries show promise and some companies are thriving, volatility is a prevalent factor. Investors must navigate political tensions and economic fluctuations carefully. Success lies not just in choosing the right stocks but also in timing your investments wisely.

To maximize your chances of success, diligence is key. Stay informed about current events impacting the Russianmarket and continuously evaluate your investment strategy. Building a diversified portfolio can help mitigate risks while capitalizing on growth opportunities.

Making quick financial gains through investing in the Russianmarket requires careful analysis, strategic planning, and responsive decision-making. With thorough research and an understanding of market dynamics, investors may find themselves well-positioned to seize beneficial prospects when they arise.